You’ve just had the most magical wedding… You spent months planning: the venue, the dress, the cakes, the cars, the rings… Nothing was left to chance – everything was meticulously planned, and on the day it was a flawless enchanted testimony to your superb organisational skills.

Your relatives adored you with praise, your photographs captured the magnificence of it all, and once the confetti has settled, you relax with pride, confident that you’ve thought of everything.

But have you?

Many newlyweds get so caught-up in the excitement of the big day that they neglect to consider some important post-nuptial issues. Issues like tax credits – boring as they sound, they can actually make some big savings for you.

Alex from Red Oak Tax Refunds has highlighted the top 3 biggest mistakes she sees for newlyweds:

Not opting for Joint Assessment

Once you get married, you can actually opt to have you and your spouse’s taxes assessed together as one which often helps to reduce the amount of tax you pay.

This works by combining your personal tax credits – a total of €3300 worth of credits – and sharing any PAYE tax credits (worth €1650 each), which often results in a smaller tax bill.

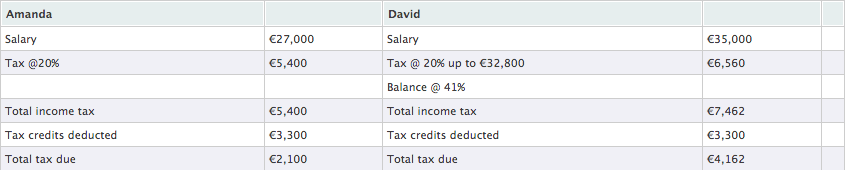

Let’s look at an example. Say Amanda and David get married but they are unaware they can be jointly assessed. Their taxes look like this:

Combined tax bill €6,262

If Amanda and David were to have their taxes jointly assessed, their taxes would look like this:

Amanda’s salary €27,000

David’s salary €35,000

Total income €62,000

Tax @ 20% €12,400

Tax credits deducted €6,600 (€3,300 + €1650 + €1,650)

Total tax due €5,800

Tax already paid €6,262 (€2,100 + €4,162)

Refund due €462

Imagine missing out on €462 less tax to pay over many years of marriage – and believe me, Revenue isn’t going to be chasing you to pay it back!

Not applying for a Year of Marriage Review

You may be eligible to get something back for the year of your marriage under what Revenue call a Year of Marriage Review. This will be a partial refund, dependent on the number of days you are married in that tax year.

In the example above, the refund for the full year was €462. But if Amanda and David were only married on 15th September that year, they would be entitled to 108 days out of the full year or 30% of the yearly refund i.e. €138.60. But, again, if you don’t apply for this, you won’t get it!

Not knowing what Tax Credits are available

Many newlyweds are unaware that getting married can open-up new tax-credit options to them.

A big one is the Rent Tax Credit. If one of you was eligible for the rent tax credit prior to getting married, you can double your rent tax credits once you get hitched.

It’s also good to know that if you have children and one of you is staying at home to mind them, there is a provision for a Home Carers credit of €810. This even allows for the ‘home carer’ to earn a small income of up to €5,080 before it starts to reduce the credit amount.

The important thing to do with all of these credits is apply for them! Don’t make the mistake of not considering your taxes – as you could be missing out. And once 4 years have passed, you can’t claim retrospectively. Weddings are an expensive occasion, so it pays to think about your taxes and claim what you’re entitled to. It will make flicking through your photo album and reminiscing about your big day all the more enjoyable!

Image via UnSplash