Are you planning to get married abroad? Then don’t forget to factor in the one hidden cost that most couples forget – the cost of sending supplier payments overseas. For example, if you have planned an amazing wedding in the US for around €70,000, but you overpaid for the cost of exchanging Euros into US Dollars, you could easily end up paying as much as €3,000 extra!

How does this happen? The answer is simple. The buy/sell rates which banks use is not the real exchange rate published by central banks. What banks do, in order to make (more) profit, is offer exchange rates which are significantly worse than the real rate. When they exchange the currency, they in turn get it for the real rates, but their customers don’t.

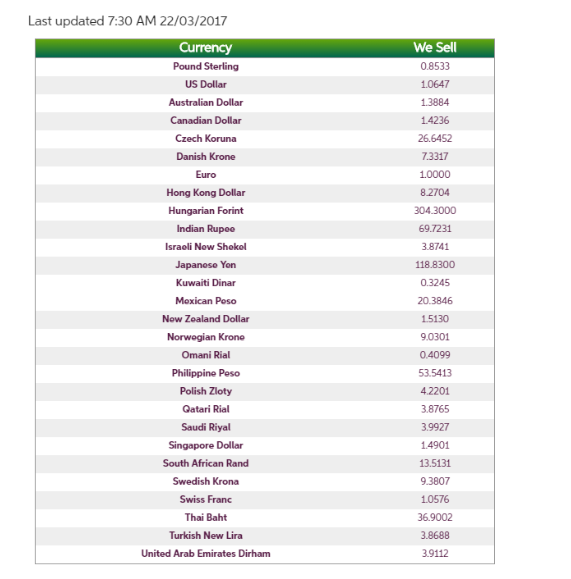

Let’s have a look at the example rates provided by AIB today:

For each Euro you will pay the bank, they will give you 0.8533 pounds. Which is great, except for the fact the real exchange rate at the moment of writing this 0.8662. That is just about 1.5% difference, which isn’t particularly bad, but is quite a lot when you are dealing with large lump sums of money. If you are getting married at home in Ireland and sending funds from countries abroad such as America and Australia, your position will be even worse. American banks are notorious for charging up to four per cent of the funds in fees.

Beyond fees and exchange rates, another detrimental factor is the current currency trend. With both the Euro and Pound Sterling fluctuating heavily over the last 12 months, it takes a certain level of expertise to time the transfer when the rates are at their most favorable.

But, there are companies which act as an intermediary service and allow people to send money abroad for a fraction of the cost. They normally charge no wire fees, better exchange rates than banks, and provide bespoke advice for clients who aren’t sure about the best timing to exchange currencies. Here is a list of the most recommended companies to move money to Ireland.

How to choose the right company to move your wedding funds abroad? Here are three simple tips:

- Choose a broker which is approved by a regulator in the UK (FCA) or Ireland (Central Bank of Ireland). Make sure they are authorised to handle client funds and not only ‘registered’ with either

- Choose a reliable currency broker who has been operating for at least five years with an extensive list of clients and positive testimonials. Don’t be a guinea pig

- Make sure you negotiate the price you are being offered. Nothing in this industry is final